Industry

The Internet of Things—a vast network of sensors and smart devices combined with advanced analytics and cloud services—promises to augment (and disrupt) many industry sectors. Bain works with customers to understand and unlock the value of IoT, and we also help IoT and Analytics vendors focus their resources and determine which battlegrounds they can most effectively compete on. Our expertise encompasses the full spectrum of IoT, from sensors, connectivity and lifecycle management to IoT platform analytics, security, applications and services.

Our IoT Insights

What We Do

What We Do

Bain brings breadth and depth to its IoT work, with capabilities that extend from global market analysis to strategy development to relevant experience and expertise on many of the capabilities at the heart of IoT. Our capabilities include:

- Helping companies create or refine an IoT strategy and determine the highest value ways to incorporate IoT into existing business processes, new businesses, and performance improvement efforts.

- Assisting companies to develop next-gen operations that incorporate IoT proofs of concept, digital roadmaps, and the associated analytics that turn data into action.

- Working with vendors to understand customer needs, form the right partnerships, focus on the most attractive opportunities, and meet the security challenges inherent in IoT devices and applications.

- Providing Advanced Analytics expertise to help customers derive maximum value from the enormous amount of data generated by IoT.

- Helping vendors scale their IoT product and service offerings as we work with customers to address the organizational changes needed to build IoT into their digital strategies.

Our IoT Consultants

Defining the Battlegrounds of the Internet of Things

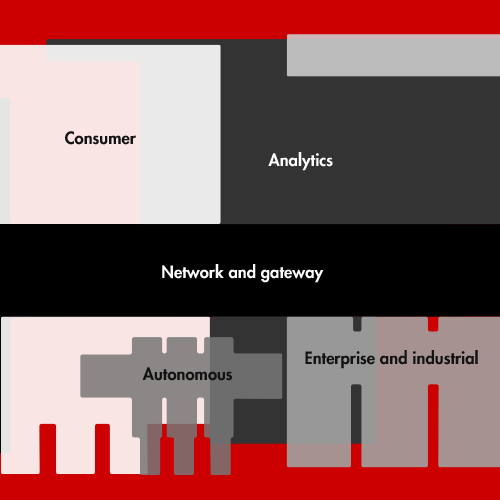

The Internet of Things is not a single market but a set of battlegrounds, each with unique opportunities.

Our Perspective

Our Perspective

The Internet of Things is not one market but a set of overlapping markets with strong connections to the data center and analytics. These markets can be thought of as battlegrounds that span consumer, enterprise/industrial, network and gateway, analytics, and autonomous applications. In the aggregate these markets will generate $520 billion in spending in 2021, more than double the $235 billion spent in 2017, with industrial/enterprise accounting for about two-thirds of that. And, although adoption expectations have dampened somewhat in the past two years, customers are planning more proofs of concept, and corporate IT departments expect to devote, on average, 25% of their budgets to IoT and analytics in 2020, up from 18% in 2018.

Customers now say that cloud service providers and analytics and infrastructure software vendors have the most influence over their IoT investments. Customers’ priorities are also beginning to shift; for example, while predictive maintenance emerged early as an attractive use of IoT technology, interest in that application is waning as the ROI proves problematic. But interest in remote monitoring is on the rise, because it is an easily integrated or standalone application. And edge analytics, which places processing power closer to the sensors and cameras that collect data, is also gaining more interest, from customers and vendors alike.

Bain research finds that the same barriers that gave customers pause in 2016 hold true today: cybersecurity, integration and ROI. Of those, security concerns may loom largest. In order for IoT markets to develop in the years ahead, vendors should focus on getting a few verticals right, paying close attention to what customers really want and need; work with partners to develop cost-effective end-to-end solutions; and prepare to scale by removing barriers to adoption. As vendors gain more experience in addressing operational considerations, they can translate that experience into repeatable playbooks that address customers’ security, integration and ROI concerns.